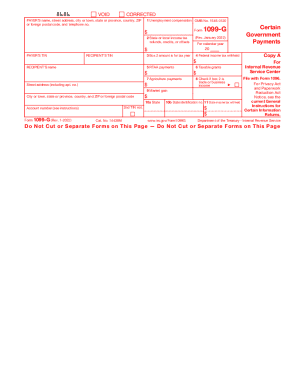

What is form 1099-G?

The 1099-G form is the Internal Revenue Service document used to notify taxpayers about received payments that must be reported on your federal income tax return.

The reason for this document is that unemployment benefits are considered as taxable income, and this record informs you how much you were paid and how much you paid in federal and state taxes.

Who should file the 1099-G form 2024?

Governments use this record on federal, state, or local levels to file the following types of payments:

- State or local income tax refunds, credits, or offsets

- Unemployment compensation

- Agricultural payments

- Taxable grants

- Reemployment trade adjustment assistance (RTAA) payments

What information is required to file the 1099-G form 2024?

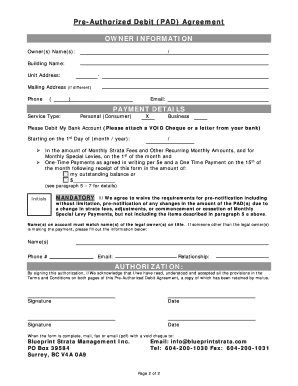

A person preparing a template should have comprehensive information about a payer and a recipient (their names, addresses, TINs, etc.) and data about the type and the amounts of received payments.

How do I fill out the IRS form 1099-G in 2025?

Filing the IRS form 1099-G is required only for local, state, or federal governments that made at least one type of payment mentioned above. The government employee or the officer must prepare a unique document for each individual from whom they have withheld any income taxes. Some government payments, such as compensation for prizes or services, are not reportable in 1099G and must be reported using 1099-MISC or 1099-NEC forms.

Is 1099 G accompanied by other forms?

As a recipient, you must attach the document to your tax return.

When is 1099 G due?

The government must deliver the document to a recipient no later than January 31 2025 to prepare their taxes before Tax Day in April. However, the exact mailing date can vary, so calling an appropriate taxing authority or unemployment office is best to clarify details.

Where do I send 1099-G?

Governmental institutions send this document to recipients of specific benefits. A recipient can use this record for preparing their tax records and doesn't need to attach it to their tax return.